- Nvidia’s closing price on December 31, 2019, was $58.60.

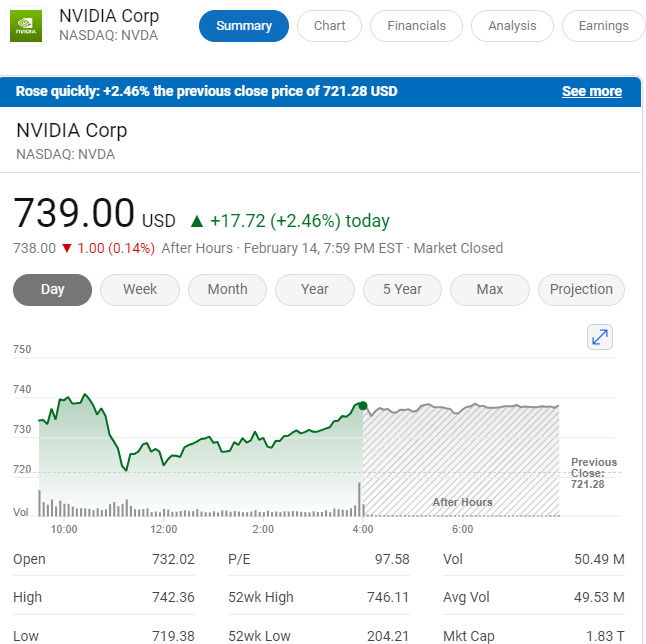

- Nvidia’s current closing price as of February 15, 2024, is $722.48.

Therefore, if you had invested $10,000 in Nvidia on December 31, 2019, and held your shares until today, your investment would be worth approximately $123,896.40. (10,000 shares * $722.48/share).

And the share price is still increasing every hour. Check Here .

With its recent upsurge, Nvidia—which has been making waves in the tech world—has become the third most valuable business in the world[1]. Analysts warn that the stock may fall by 5% even with a solid results consensus. Nevertheless, Nvidia’s incredible rise places it in a position to compete with other industry titans like Apple, Microsoft, Amazon, Alphabet, and Meta, and it may even enter the $1 trillion club in the coming years[2].

Nvidia in 2019: The Silicon Symphony

In 2019, Nvidia was the belle of the ball in Silicon Valley. The company was on a roll, pushing the boundaries of graphics technology and making gamers and investors alike drool over their advancements. The year had its share of whispers about potential stock growth, but who could have predicted the rollercoaster that awaited?

The Rollercoaster Begins

2020: The Year of the Unexpected

2020 hit the world like a curveball in a fastball game. Pandemics, lockdowns, and a dash of uncertainty – not exactly the cocktail party we all signed up for. Nvidia, being part of the tech elite, experienced its own set of ups and downs. But hey, where’s the fun if there’s no rollercoaster ride?

The Grand Rebound

2021: Nvidia’s Phoenix Moment

Fast forward to 2021, and Nvidia wasn’t just bouncing back; it was soaring higher than my coffee consumption during finals week. The company’s graphics cards were hotter than a summer day in the desert, and investors were dancing a jig. If you were in the game with your $10,000 investment, you were probably feeling like the Wolf of Wall Street.

A Dash of Humor and Real Talk

Now, let me drop some wisdom like breadcrumbs on a Hansel and Gretel trail. Investing ain’t a crystal ball game. It’s more like a game of poker with the stock market, and sometimes, the market likes to bluff. So, if you were expecting your investment to skyrocket like Elon’s Tesla on a SpaceX mission, well, reality check – even Nvidia had its bumps.

But hey, life’s too short for boring stock talks. Let’s add a sprinkle of humor to this financial stew. Investing in Nvidia is like ordering a pizza – you never know which topping will become the star. In 2019, it was all about the cheese, and by 2022, it had more toppings than a California pizza.

Lessons from the Nvidia Odyssey

1. Tech Land is a Wild West

Investing in tech is like riding a mechanical bull – thrilling, but you might end up on the floor. Nvidia’s journey shows that tech stocks can be as unpredictable as a cat on a skateboard.

2. Patience is a Virtue, Not Just a Cliché

If you were sweating bullets during the 2020 dip, pat yourself on the back if you held tight. The stock market is a marathon, not a sprint. Sometimes you win, sometimes you learn.

3. Diversification is the Name of the Game

Putting all your eggs in one silicon basket? Risky move, my friend. Diversification is your financial superhero cape – wear it proudly.

Conclusion: From Pixels to Profits

So, there you have it – the Nvidia saga in a nutshell. If you threw $10,000 into the Nvidia arena in 2019, you’re probably sipping a celebratory beverage right about now. But remember, the stock market is a rollercoaster, and predicting its twists and turns is as futile as predicting the weather in April.

Invest wisely, diversify like a pro, and hey, why not enjoy the ride? After all, life is too short for boring investments, and sometimes, the best returns come with a sprinkle of humor and a dash of unpredictability. Cheers to the pixelated profits and the tech rollercoaster!