The forecasted decrease in mortgage rates occurs when the Federal Open Market Committee lowers the benchmark interest rate, which is anticipated to occur in the second half of 2024. Yet rates will stay high at current levels as long as inflation continues to run higher than the Fed would like.

Though estimates of how much rates will ultimately decline vary, most economists forecast that they will progressively decline each quarter. Certain analysts predict that by year’s end, rates will drop to about 6%, while others predict that they will remain high in the mid-6% range[1]. Stay tuned for more accurate updates by monitoring market trends and economic indicators!

The Mortgage Bankers Association predicts a gradual decrease throughout 2024, reaching 6.1% by the end of the year[2].

Many people have expressed interest in mortgage rates, particularly those who want to refinance their current loan or purchase a property. Although I lack a crystal ball, I can offer some insights based on professional forecasts and current market conditions:Here’s the data on 2024 mortgage rate forecasts from various sources presented

| Source | Forecasted 30-Year Mortgage Rate |

|---|---|

| Freddie Mac[3] | Above 6.5% through this quarter and the next |

| Fannie Mae Housing Forecast[4] | 6.4% by the end of 2024 |

| National Association of Realtors[5] | Likely in the 6% to 7% range for most of the year |

| Mortgage Bankers Association (MBA)[6] | 6.1% at the end of 2024, gradually declining to 5.5% by the end of 2025 |

| Bank of America[7] | Gradual drops, possibly starting later in 2024 |

| MLS chief economist[8] | Rates to hit 6.2% by Q4 2024 |

| KPMG Economics[9] | Expected to stay below 7% in the coming months |

Keep in mind that these are expert predictions, and actual rates may vary based on economic conditions and other factors.

Impact of Larg Downpaymnet on Mortgage Rates

Your mortgage rates might be greatly impacted by a greater down payment. This is how it operates:

Lender Risk Reduction: Lender risk is diminished when a higher down payment is made. If you make a sizable down payment, your loan amount will be lower than the worth of the house. Because you have more equity in the property, lenders see this favorably. As a result of the decreased risk, they might provide you a cheaper interest rate1.

LTV, or loan-to-value ratio: The ratio of your loan amount to the home’s assessed value is known as the loan-to-value (LTV) ratio. A lower LTV ratio is the outcome of a larger down payment. Because lower LTV ratios signify a stronger financial condition, lenders prefer them. Better rates are correlated with lower LTV ratios1.

Avoiding Mortgage Insurance: You can avoid private mortgage insurance (PMI) if you make a 20% down payment. In most cases, PMI is necessary if your down payment is less than 20%. You can eliminate PMI, save money on extra expenses, and possibly even get lower rates1.

To demonstrate the effects of varying down payments on a standard home loan of $400,000, let us consider the following:

| Down Payment (%) | Interest Rate (%) | Monthly Payment ($) | Total Cost ($) |

|---|---|---|---|

| 3 | 6.75 | 2517 | 905962 |

| 5 | 6.00 | 2278 | 820185 |

| 10 | 5.50 | 2044 | 735855 |

| 20 | 4.50 | 1930 | 583702 |

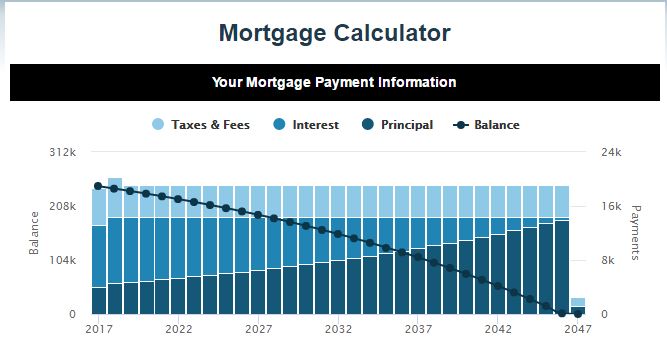

Several online mortgage calculators can be used to estimate your monthly mortgage payment. Here are several possibilities:

Zillow’s Mortgage Calculator

- Business Insider’s Equation:

- You can calculate your monthly mortgage payment (excluding property taxes and insurance) using the following equation: [ M = P \left( \frac{{i (1 + i)^n}}{{(1 + i)^n – 1}} \right) ]

- (P) represents the principal (the loan amount).

- (i) is the monthly interest rate (different from the interest rate on your mortgage documents)².

- LendingTree’s Formula:

- If you prefer doing the math yourself, here’s the equation used in the mortgage calculator: [ A = P \left( \frac{{r (1 + r)^n}}{{(1 + r)^n – 1}} \right) ]

- (A) is the payment amount per period³.

- Redfin’s Calculation:

- Redfin’s mortgage calculator uses the formula: [ P = L \left( \frac{{c (1 + c)^n}}{{(1 + c)^n – 1}} \right) ]

- (P) is the monthly mortgage payment.

- (L) is the mortgage loan amount.

- (c) is your mortgage interest rate.

- (n) is the number of monthly payments over the lifetime of the mortgage⁴

- Use this free tool to calculate your monthly mortgage payments with PMI, taxes, insurance, and more.

- Compare different loan terms, rates, and options for your home purchase or refinance

– MortgageCalculator.org Link

Keep in mind that your monthly home payment covers more than just loan repayment. Taxes, homeowner’s insurance, and other expenses are also covered. Use these calculators to learn more about your mortgage payments.